LIVE A HAPPY WEALTHY LIFE

Got big goals and dreams ahead of you?

Wouldn’t it be nice to have a financial expert in the family? One that could help you navigates the everyday financial maze of life? Helping you to understand and optimize various financial situations is central to our role. Should you pay cash or finance your next car, might you be eligible for college financial aid, what health insurance plan is best for you, how can you maximize the value of your business?

Count on us, we are your Personal CFO

We develop a deeper understanding of your goals and your life, so that we can provide advice that spans your entire balance sheet and your entire income statement—just as a Chief Financial Officer would for a company.

A Solid Financial Strategy Isn’t a Luxury—It’s a Priority

Goal Planning – Financial Strategies

For Individuals & Families.

Get unique financial strategies from your Personal CFO

As an independent financial goal planners, we look beyond just returns. Our aim is to approach your finances systematically by examining your cash flow, debts, risk covers and current investments among more.

As your Personal CFO we:

-

1Partner with you, step-by-step, as your trusted financial guide.

-

2Create a big picture view of your financial health.

-

3Build a financial strategy in accordance with your life goals.

-

4Serve as a trusted partner during significant life events.

-

5Alleviate the hassle of financial management.

SERVICES

What We Do

As a successful individual, your needs are special. Having worked with numerous individuals & their families, and NRI’s in managing their wealth, we understand how important a comprehensive approach is for you. Hence we summed up our services in two words – Personal CFO.

We help you with,

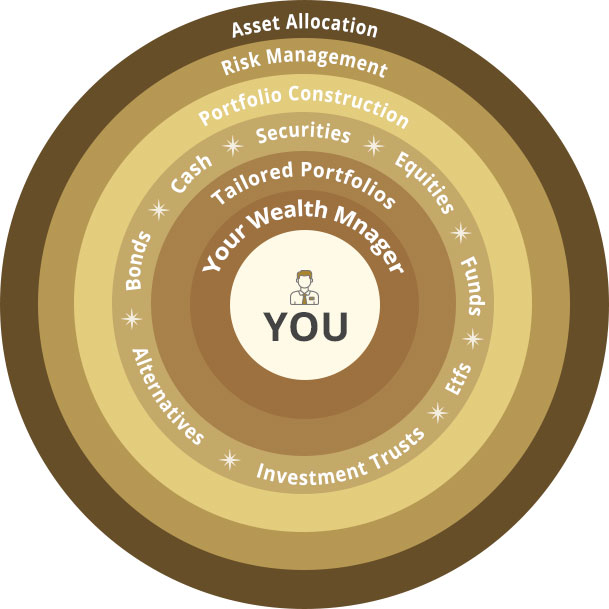

Investing with Northstar Wealth gives you access to a broad range of financial services.

We are always on your side

We are not aligned to any of the banks or financial institutions. This enables us to access wide variety of investment products and services which works for your best interest.

We look at the big picture of your financial life and work solely on your behalf.

Testimonials

How your personal CFO helps you in four steps

Understanding You

Information Analysis

Blueprint

In Action

Why we are different?

Access to Best

Investment Ideas

We put our global experience, relationships, and research to work to find the most appropriate investments ideas with the highest potential to meet financial goals.

Intelligent

Guides

Our investment professionals bring knowledge and acumen built over decades of experience across client types and asset classes.

Deep

Partnerships

Our investment team works diligently to understand your unique needs and customizes a portfolio and experience to match.

Alignment with

Clients

Our decisions are motivated only by your interests; we sell no proprietary investment products and accept no incentives from managers.

Book an initial consultation

Please fill in your details to book an initial consultation with our investment experts.

How it works: